Schedule 17(4)

Question: What is schedule 17(4) and what related companies does my company have to report?

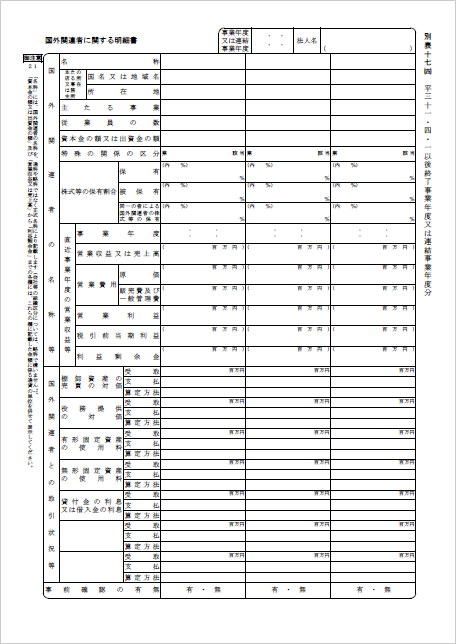

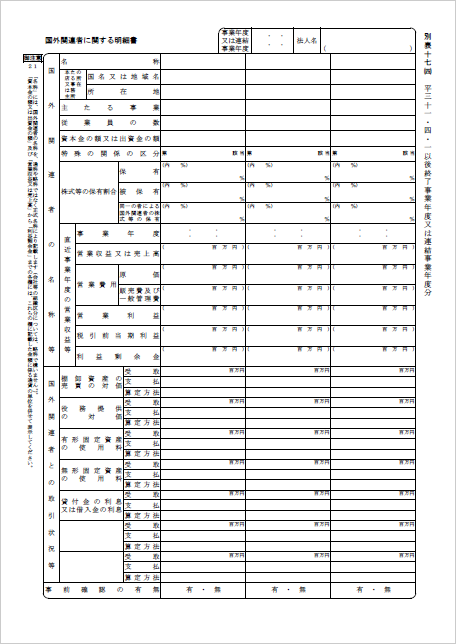

Answer: Schedule 17(4) is a form necessary for some Japanese corporate tax returns. As part of the larger and ongoing transfer pricing taxation project and legislation, companies that fall under the Transfer Pricing Tax System in Japan must report on their transactional interactions with and relationships to companies outside of Japan.

In this blog post, we would like to explain a little bit more about the “relationship” category as any companies transacting with Japanese companies and with these kinds of relationships must be reported on schedule 17(4). Per Japanese tax law, there are 5 categories of intercompany relationships as described below.

1.Parent-subsidiary

One company’s direct or indirect ownership is more than 50% in one company

2.Sibling

One company/person’s direct or indirect ownership is more than 50% in two different companies

3.Effective management (substantial control)

Any of the 3 following conditions are met:

1) Management through having representative rights or through controlling more than 50%

of company representatives

2) Control of a major operation of the business

3) Management through equity loans, guarantorship, etc

4.Connection through stocks and effective management

5.Connection through any combination of stocks and effective management

If your company has transactions with a directly or indirectly related overseas company, you may have to file a schedule 17(4). At TOMA, we are ready to help you, from making that determination to preparing a schedule 17(4) for you.

TOMA Consultants Group English Site ⇒ http://toma.co.jp/en/

別表十七(四)

Question: 別表十七(四)とはどんなものですか。また、当社はどの会社の記載が必要でしょうか。

Answer: 別表十七(四)は法人税申告書の別表です。移転価格税制の適用対象となる国外の法人(国外関連者)と取引がある場合に記載する必要があります。

今回は、この別表の記載にあたり判定が難しい国外関連者との「特殊の関係の区分」について説明します。

税法では5つの区分が定められてあります。

第1号 親子関係:発行済株式等を直接的又は間接的に50%以上保有する関係

第2号 兄弟関係:2つの法人が同一の者(個人を含む)に直接的、若しくは間接的に

2つの法人が同一の者(個人を含む)にそれぞれの50%以上

第3号 実質的支配関係:

下記のいずれかに該当する関係

1) 会社の代表権又は役員の2分の1以上による支配

2) 事業活動の相当部分を支配

3) 事業資金の借入れ又は保証等による支配

第4号 持株関係及び実質的支配関係の連鎖

第5号 持株関係又は実質的支配関係のいずれかの組み合わせによる連鎖

国外の法人と上記の関係がある場合には、法人税申告書別表十七(四)の別表提出が必要となります。 詳細はTOMAコンサルタンツグループまでお気軽にお問い合わせください。