Tax measures to promote global financial centers

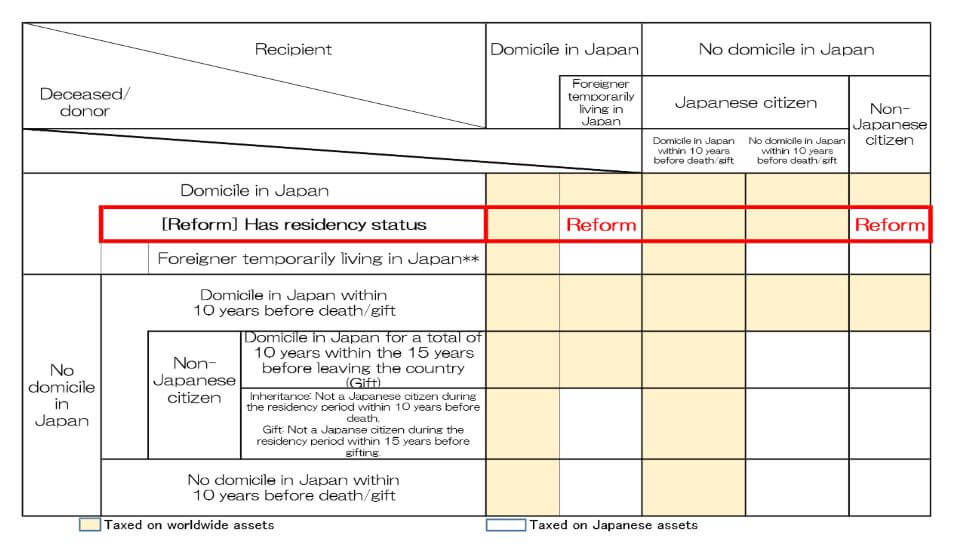

Inheritance/gifts of overseas assets will no longer be subject to inheritance/gift tax if the following conditions are met:

1. The recipient is a foreigner with residency status* temporarily residing in Japan or a foreigner residing outside of Japan; and

2. The deceased/donor is someone with residency status.

* Holds a visa covered under Table 1 of the Immigration Control and Refugee Recognition Act

** Someone who is in Japan for 10 years or less out of the last 15 years and holds a visa covered under Table 1 of the Immigration Control and Refugee Recognition Act