Contents

How is allowance for doubtful accounts (or bad debt reserve) used by Japanese companies? What are the rules surrounding the deductibility of such expense under Japanese corporate tax law? Keep reading to learn more.

Allowance for Doubtful Accounts

Companies often utilize allowance for doubtful accounts (also known as bad debt reserve) to estimate uncollectible receivables. This can include credit sales, loans, and other monetary claims.

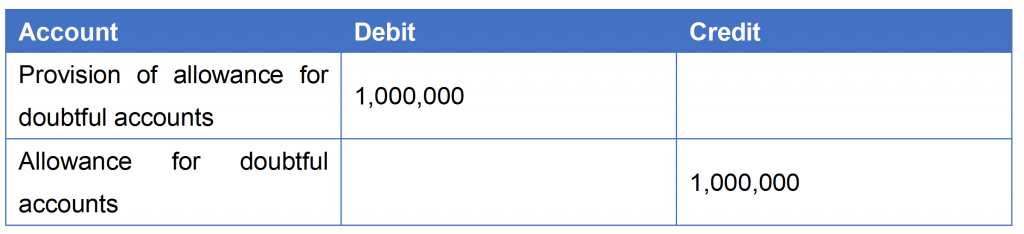

On the accounting books, this is recorded as follows.

“Allowance for doubtful accounts” is a contra-asset account that estimates future loss from uncollectible receivables, while “provision of allowance for doubtful accounts” is the corresponding expense account. (Note the distinction from “bad debt expense,” which represents actual uncollectible claims.)

Treatment Under Japanese Tax Law

Japanese tax law places stringent limitations on allowances and provisions, as they allow companies to manipulate taxable profit. This is also the case for allowance for doubtful accounts.

However, under Japanese tax law, ordinary corporations with stated capital of JPY 100 million or less and certain other entities* may utilize allowance for doubtful accounts, with a cap on the amount deductible for corporate tax purposes. The calculation for this cap differs between the type of receivable, which we will outline in the following sections.

* Public interest corporations, cooperatives, unincorporated associations, banks, insurance companies, and corporations with monetary claims related to financial transactions.

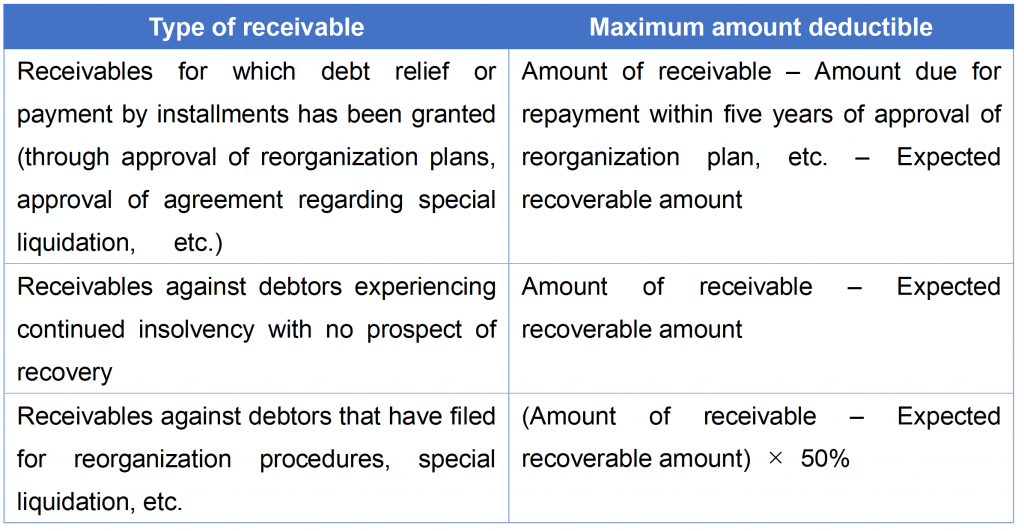

Receivables Subject to Individual Evaluation

This category of receivables contains those that are unlikely to be recovered. As the name suggests, the amount deductible under Japanese tax law for these receivables is evaluated on an individual basis.

Receivables Subject to Collective Evaluation

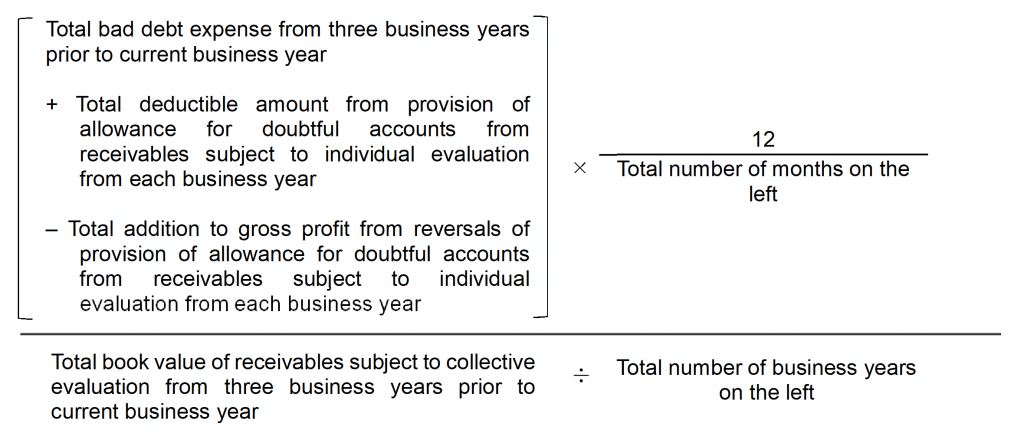

This category includes receivables other than those listed in the previous section. The maximum amount deductible in regards to receivables subject to collective evaluation is calculated as follows:

Total book value of receivables subject to collective evaluation ╳ historical bad debt ratio

The “historical bad debt ratio” is derived from an intricate formula defined as follows:

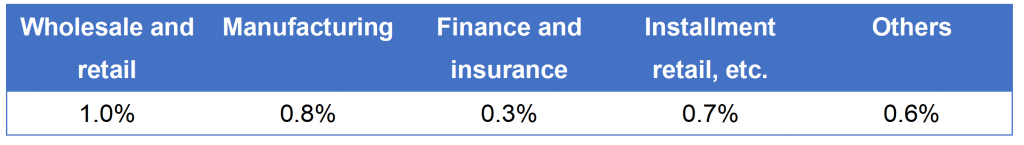

Alternatively, ordinary corporations with stated capital of JPY 100 million (excluding companies with average taxable income of over 1.5 billion yen over the last three years), public interest corporations, cooperatives, and unincorporated associations may use the much simpler “legal provision rate” instead of the historical bad debt ratio. The legal provision rate differs depending on the industry to which the company belongs.

TOMA’s Services

TOMA Consultants Group has a team of Japanese tax experts to help you navigate Japan’s complex corporate tax system. We handle tax filing for foreign companies, with special consideration for factors such as allowance for doubtful accounts, director’s compensation, and entertainment expenses, so that you can focus on your core operations.

Please reach out to us through the form below for a free consultation

On-demand Seminar Information

A Guide to the Qualified Invoice System (On-demand Seminar)

The Qualified Invoice System, starting October 2023, introduces new changes to the Japanese consumption tax rules and will affect many businesses across Japan.

The system requires a redesign of existing invoices, as well as a review of the business’ consumption tax status and suppliers.

This online seminar aims to give you an overall understanding of the Qualified Invoice System and provide measures to help you navigate the new requirements.